Cryptocurrency has gone from being a niche internet talking point to a global financial topic of discussion. As it started as a mere digital alternative to money, crypto has now risen in popularity, as evidenced by people searching the current market Ethereum price. With its promise of decentralization, transparency, and inclusivity, crypto has captured the attention of significant business tycoons who recognize its potential to reshape finance. Many influential figures across industries have either invested directly in cryptocurrencies or backed blockchain technology. Here, we explore some of the most notable business moguls who are championing the cause of crypto and blockchain.

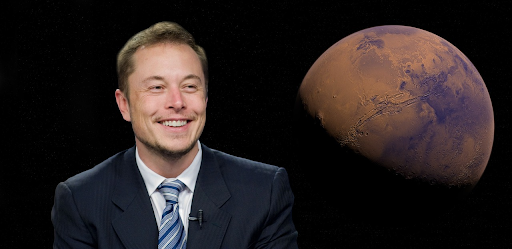

1. Elon Musk

One of the most influential and vocal figures in the crypto world is Elon Musk, CEO of Tesla and SpaceX. Musk’s tweets alone have been known to impact cryptocurrency prices dramatically. In early 2021, Tesla invested $1.5 billion in Bitcoin and announced plans to accept Bitcoin as payment, though this decision was later put on hold due to environmental concerns. However, Musk has continued to advocate for Dogecoin, a meme cryptocurrency initially started as a joke.

Despite his critical views on Bitcoin’s energy consumption, Musk’s support for Dogecoin demonstrates his interest in more sustainable cryptocurrencies. Musk’s involvement in cryptocurrency has brought immense mainstream attention to the market, showing the impact a single business leader can have on the industry.

2. Jack Dorsey

Jack Dorsey, co-founder and former CEO of Twitter and CEO of Square (now Block), has been a consistent supporter of Bitcoin, even calling it “the most important thing” he’s ever worked on.

Square made headlines when it invested $50 million in Bitcoin in 2020, adding another $170 million the following year. Dorsey also founded a Bitcoin development fund and has supported Bitcoin-based projects like the Lightning Network to make transactions faster and cheaper. Dorsey’s unwavering support reflects his vision of cryptocurrency as a tool to empower people and create a more equitable financial system.

3. Michael Saylor

Few have championed Bitcoin as vigorously as Michael Saylor, CEO of MicroStrategy, a business intelligence company. Under his leadership, MicroStrategy has accumulated more than 120,000 bitcoins, making it one of the largest corporate holders of Bitcoin globally. Saylor’s rationale is that Bitcoin is a hedge against inflation, describing it as “digital gold” that can preserve wealth in an uncertain economic environment.

Saylor has frequently argued that traditional assets like cash depreciate over time, while Bitcoin’s finite supply makes it a reliable store of value. He has become a well-known advocate for Bitcoin and frequently speaks at industry conferences, sharing insights on the advantages of adding Bitcoin to corporate treasuries.

4. Mark Cuban

Shark Tank investor and owner of the Dallas Mavericks, Mark Cuban, initially held skeptical views on cryptocurrency but has since emerged as one of its biggest advocates. Cuban is particularly interested in Ethereum and decentralized finance applications. He has invested in a range of blockchain-based companies, such as OpenSea, a marketplace for non-fungible tokens (NFTs), and Mintable, an NFT minting platform.

Cuban sees intelligent contracts—self-executing contracts on the blockchain—as revolutionary. His NBA team, the Mavericks, even accepts Dogecoin for merchandise purchases. Cuban’s pragmatic approach highlights his belief in the potential for blockchain applications to change the digital economy in more ways than one.

5. Tim Draper

Venture capitalist Tim Draper has long been a staunch supporter of Bitcoin and blockchain technology. In 2014, Draper bought nearly 30,000 bitcoins seized by U.S. authorities from the Silk Road marketplace. He has since continued to invest in Bitcoin and blockchain startups.

Draper’s investment in Bitcoin is tied to his optimistic view of the technology’s potential to disrupt traditional industries like banking, healthcare, and real estate. He has famously predicted that Bitcoin could reach $250,000 in the near future, driven by increased adoption and technological innovation. Draper’s forward-looking investments underscore his belief that blockchain technology is on the cusp of revolutionizing multiple sectors.

6. Cathie Wood

Cathie Wood, CEO of Ark Invest, is one of Wall Street’s most prominent supporters of Bitcoin. Her investment firm, Ark Invest, was an early adopter of Bitcoin, viewing it as a disruptive asset with substantial long-term growth potential.

Under her leadership, Ark Invest has bought shares in companies with exposure to Bitcoin, such as Tesla and Coinbase, and has developed exchange-traded funds (ETFs) that include companies involved in blockchain technology. Wood’s advocacy for Bitcoin and her substantial investments in cryptocurrency illustrate her commitment to Bitcoin’s place in the modern financial system.

7. Brian Armstrong

Brian Armstrong, CEO of Coinbase, has been a driving force in making cryptocurrency more accessible to the general public. Coinbase, one of the world’s largest cryptocurrency exchanges, went public in April 2021, a historic event that signaled the growing institutional acceptance of crypto. Armstrong believes that cryptocurrencies represent the future of financial systems, arguing that traditional banking often fails to provide services to all people.

Coinbase has introduced products aimed at reducing barriers to crypto investment and has encouraged the adoption of decentralized financial products. Armstrong’s leadership has been instrumental in driving the crypto economy forward as Coinbase continues to bring more users into the space.

Conclusion

The support of these prominent business tycoons has helped legitimize cryptocurrency as a severe financial asset. While each of these leaders has their motivations—whether for financial inclusion, technological advancement, or as a hedge against inflation—they all see value in cryptocurrencies’ disruptive potential. Their backing has also influenced broader public and institutional interest in the crypto space, proving that blockchain technology is more than a passing trend.

As cryptocurrency continues to evolve, the backing of high-profile investors will likely drive further innovations, ultimately transforming the landscape of global finance. The growing interest of these business magnates suggests that crypto and the blockchain technology underlying it are here to stay, promising exciting changes in the world economy for years to come.

Keep an eye for more latest news & updates on Tribune Indian!